What Is a Newcomer Mortgage?

Most Canadians will need to get a mortgage loan in order to purchase a home. A newcomer mortgage is a special mortgage program offered by some banks in Canada for those new to Canada. They are designed to help newcomers get a mortgage even if they don’t meet the eligibility requirements for a regular mortgage.

The main reasons why it can be difficult for newcomers to get a regular mortgage include:

A bank will look at your credit report to see how you have been handling debt. This includes a history of payments, such as whether or not you have missed any payments or made late payments, along with your balances and credit limits. An established credit history shows that you have been consistently responsible with your finances. In some cases you may need to provide bank statements to determine credit worthiness or supply a foreign credit report.

For those new to Canada, you might not have a work history and credit history in Canada. With a newcomer mortgage program, banks are more lenient on their eligibility requirements. However, you will need to meet certain criteria in order to be considered a newcomer to Canada.

Mortgages for those new to Canada can be insured against mortgage default by the Canada Mortgage and Housing Corporation (CMHC), Sagen, or Canada Guaranty. These insurers all have basic borrower qualifications. In order to be eligible for a newcomers mortgage:

You will need to make a down payment of at least 5%. This minimum down payment requirement can be higher, such as if the home price is over $500,000. Your lender can require the minimum down payment to come from your own resources and savings, rather than being gifted or borrowed.

Your debt service ratio shows how much of your income goes to service your debt. The higher this ratio, the worse it is, since you’re spending more of your income to service debt. You will need to have a gross debt service ratio (GDS) of 39% or less, and a total debt service ratio (TDS) of 44% or less.

The mortgage stress test rate will be used to test your GDS and TDS ratios. Your foreign debt is included when calculating your GDS and TDS, but your foreign rental income is not included.

If you meet the criteria above now is the time to give us a call to determine your affordability and lock in a rate!

Taking the hassle out of the mortgage process & simplifying your life

There are generally two ways to get a mortgage in Canada: from a bank, or from a licensed professional mortgage broker. While a bank only offers the products from their particular institution, licensed mortgage brokers send millions of dollars in mortgage business each year to Canada’s largest banks, credit unions, trust companies, and financial institutions; offering their clients more choice, and access to hundreds of mortgage products! As a result, clients benefit from the trust, confidence, and security of knowing they are getting the best mortgage for their needs. Click here to start the mortgage process!

Home Purchases

The purchase of a home is the largest purchase most people make during their lifetime. When purchasing a home in Kitchener or Waterloo, Dominion Lending Centres can help you get started on the right path.

Dominion Lending Centres Kitchener wants to make each and every purchaser aware of the many mortgage options available to them prior to their purchase and closing date.

Now, more than ever, financial institutions are regularly launching new products and programs, making it easier to get into that new home sooner. Today, interest-only loans, self-employment programs, rental purchase programs, vacation property programs, and a host of other innovative financing alternatives are dotting the home purchase landscape, making homeownership a reality for more people than ever.

Whether you are a first-time buyer or an experienced buyer with excellent credit, Dominion Lending Centres has access to the very best products and rates available across Canada. Give us a call…we think you’ll be pleasantly surprised!

If you are looking for a new home, be sure you are pre-approved. With a mortgage pre-approval, a licensed mortgage professional can do a more complete verification prior to sending you shopping for a home, and with that done, the dollar figure you are going shopping with is actually what you can spend.

The mortgage professional that you work with to get pre-approved will let you know for certain what you can afford based on lender and insurer criteria, and what your payments on a specific mortgage will be.

Dominion Lending Centres mortgage professionals can lock-in an interest rate for you for anywhere from 60-120 days while you shop for your perfect home. By locking in an interest rate, you are guaranteed to get a mortgage for at least that rate or better. If interest rates drop, your locked-in rate will drop as well. However, if the interest rates go up, your locked-in interest rate will not, ensuring you get the best rate throughout the mortgage pre-approval process.

In order to get pre-approved for a mortgage, a mortgage professional requires a short list of information that will allow them to determine your buying power. A Dominion broker will explain to you the benefits of shorter or longer mortgage terms, the latest programs available, which mortgage products they believe will most likely meet your needs the best, plus they will review all of the other costs involved with purchasing a home.

Getting pre-approved for a mortgage is something every potential home buyer should do before going shopping for a new home. A pre-approval will give you the confidence of knowing that financing is available, and it can put you in a very positive negotiation position against other home buyers who aren’t pre-approved.

Mortgage Renewals

While most Canadians spend a lot of time, and expend a lot of effort, in shopping for an initial mortgage, the same is generally not the case when looking at mortgage term renewals.

By omitting proper consideration at the time of renewal, this practice costs Canadian citizens thousands of extra dollars every year. Nearly 60% of borrowers simply sign and send back their renewal that is first offered to them by their lender without ever shopping around for a more favourable interest rate.

Homeowners should never accept the first rate offer from their existing lender. Without any negotiation, simply signing up for the market rate on a renewal is unnecessarily costing the homeowner a lot of money on their mortgages in Kitchener.

Generally it is a good idea to start shopping for a new term between four and six months before your current mortgage term expires. Many lenders send out your renewal letter very close to the time that your term expires and this does not give you ample time to arrange for a mortgage term through a different lender. This means that you need to be tracking your own mortgage term timeframe and know when it is time to start shopping for a good mortgage renewal rate.

Before you ever hear from your lender about renewing your mortgage term, have a licensed Dominion broker shop around for you, you will be amazed at what they can accomplish on your behalf!

Your mortgage is one of your biggest expenses. For this reason it is imperative to find the best interest rates and mortgage terms you possibly can. By shopping around at renewal time you can save substantial amounts of money over the life of your mortgage loan. Don’t be one of the 60% who just simply sign their renewal letter and send it back. Use the services of a licensed Dominion Lending Centres mortgage professional to ensure the lenders compete for your business in Kitchener and Waterloo.

Mortgage Refinancing

Canadians today face many reasons to refinance their mortgage.

For example, you may have been working at improving your credit score and now qualify for a new mortgage with a better discount, or you may want to stabilize your payments by changing from a variable rate mortgage to a fixed-rate.

Refinancing is also a good option to pull out equity for consolidating debt, home improvements, investments, college expenses, and more.

Contact Kitchener Mortgage broker, Leslie Morris for more information.

One of the best Mortgage Calculators in the Industry!

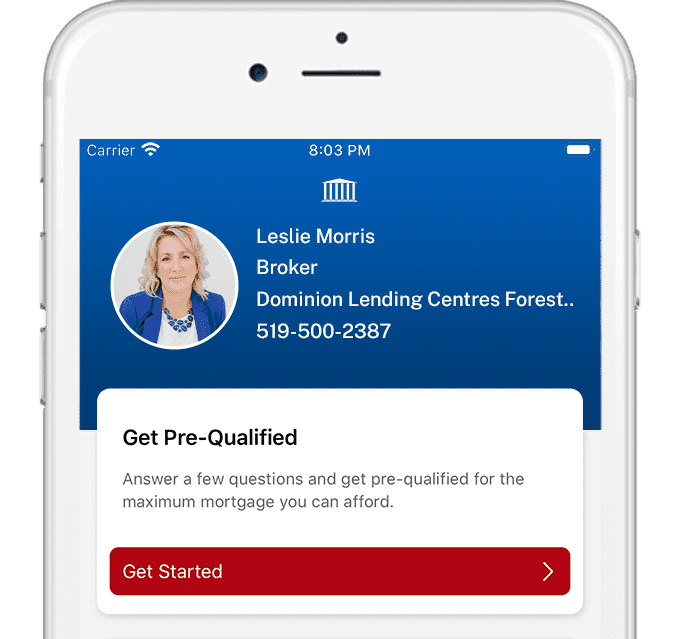

Get the Mortgage Toolbox App!

You can now download our app on Android and iOS and get exclusive access to all the premium tools to help you plan your mortgage.

Calculate your total cost of owning a home

Estimate the minimum down payment you need

Calculate Land transfer taxes and the available rebates

Calculate the maximum loan you can borrow

Stress test your mortgage

Estimate your Closing costs

Compare your options side by side

Search for the best mortgage rates

Email Summary reports (PDF)

Use my app in English, French, Spanish, Hindi and Chinese

Credit Repairs

As credit has become more and more abundant in our society, your credit report, and thus your credit rating, has become more important in your daily life.

Your credit rating affects all aspects of your financial activities when it comes to borrowing money. Your credit rating also has the ability to affect the job you get, the apartment you rent, and even the ability to open a bank account.

Your credit report itself is simply a listing of all of your mortgage and consumer debt. Here in Canada, the two main credit reporting agencies are TransUnion and Equifax. Both agencies have a credit history file on anyone who has ever borrowed money. Every time you borrow money, or make a payment on a loan or credit card, the lender then reports the information about the transaction to these two agencies. In addition to credit information, you will also find liens and judgments on your credit report as well as your address and possibly your work history. The accumulation of all of this information is called your credit report.

The information on your credit report varies based on your creditors and what they have reported about you. Potential Dominion Lenders and others, such as employers, view your credit history as a reflection of your character. Whether we like it or not, our financial habits have a lot to say about the way in which we choose to live our lives.

The credit score, or beacon score, is a number which gives mortgage lenders an idea of your lending risk. Credit scores range from 300 to 900, the higher your credit score the better. The mortgage products and interest rate that you will qualify for are often determined by your credit score.

One thing that many people do not know is that you have the legal right to obtain a copy of your credit report. A mortgage professional can help you obtain a copy of this report and go through it with you to verify that all of the information is true and correct.

The good news is that your credit report is a working document. This means that you have the ability over time to repair any damaged credit and increase your credit score.

Chip Reverse Mortgage

When most of us dream of retirement, we imagine ourselves in our homes—sharing a meal with family or just relaxing in a comfortable spot. But retirement can also bring financial strain. Seniors often face the challenge of managing with less cash flow than they anticipated or coping with unforeseen expenses. We understand. HomEquity bank is the only bank dedicated to empowering older Canadian homeowners with smart, simple ways to use the value of their home during retirement. For over 25 years The Canadian Home Income Plan (CHIP) our reverse mortgage solution has helped thousands of older homeowners enjoy more financial flexibility without having to sell or move. CHIP might be the solution for you.

Features of a CHIP Reverse Mortgage

- Homeowners age 55 and older

- No payments are ever required

No income qualifications

No credit requirements

- Qualify for up to 50% of the value of the home

- Money can be received as a lump sum, or over time or combination

- Owner maintains title

- They can sell or move at anytime

- Receive the money tax free